Unit Trust Vs Retirement Annuity

Retirement annuities are not the only option You can also use local and offshore unit trusts direct share portfolios and endowments to supplement your traditional retirement funds. Retirement Annuity RA Contributions are tax deductible up to 275 of your income or max R350 000 You can withdraw money only when you retire age 55 earliest When you retire only the first R500 000 withdrawal is tax-free.

The income is predictable and fixed.

Unit trust vs retirement annuity

. Come retirement you can sit back and reap the rewards of your forethought and labour. Not subject to estate duty. I am retiring in the next 12 months. When you establish the trust you set a reasonable and permissible fixed annual income based on a percentage of the initial market value of the assets.Not to mention peace of mind. Retire from paycheck to passive income. Limited to no more than 75 in sharesequity and 30 offshore. This provision applies to any annuity owned by an entity other than.

Make sure your broker discloses all the fees you will be paying including his own. Old Mutual Retirement Annuity is rated one. As a general rule separate your retirement. Whats in it for you.

A normal life-insurance retirement annuity is based on a policy a unit trust retirement annuity is not. Double tax liability for early withdrawal of retirement benefits. Reinvent your retirement goals and pay for your desired lifestyle. Complete our risk profiler.

10 Reasons for PPS as exclusive product supplier for professional individuals. Purchasing power of your pension. Your retirement annuity is unlikely to generate more than a 5 real after-inflation return over the long term. When an annuity is owned by a trust the holder of the annuity is deemed by Section 72 s 6 A to be the primary annuitant.

Prosperity fund of funds. Unlike a pension or provident fund where the ultimate decision rests with the trustees on how the funds will be paid out on death with an RA your appointed beneficiaries are paid out directly. Retirement annuities in perspective. Contributions have no tax.

Conversely all of the funds in a unit trust for retirement can be accessed at any stage. This makes the unit-trust type retirement annuity more flexible as you are not bound by the policy terms and you do not incur penalties when you break these terms eg by stopping or. A little can go a long way. Investment trusts are also known as closed-ended funds because they tend to raise a set amount of cash then invest it.

Its also a super tax-efficient vehicle in which to invest your pre-retirement money. Over 40 years this will halve the real value ie. What are unit trust funds. Even as the value of the trust fluctuates your income remains the same - except in the very unlikely and uncommon event the trust is.

If you pay fees of 2 pa you reduce that return by 40 or more. You are not taxed on retirement annuity returns like investment income dividends and capital gains. Property investments versus Retirement Annuities RAs The value of a financial planner and the five categories of clients. In retirement the annuity income of such a portfolio would be a 100 taxable at the individuals marginal rate.

The drawdown from your compulsory annuity becomes your retirement income. You may decide to retire early use the funds to pay off expensive debt or cater for an emergency expense. The decision of whether to invest in retirement Annuities or Unit trusts is a debate which has gained new ground since the proposed change to regulation 28 of the Pension Funds Act and revolves around tax benefits and the possibility of restricting investment types to retirement funding instruments. In the case of a discretionary investment the.

Unit trusts are also referred to as open-ended funds because they will always accept more cash from investors they just become bigger to accommodate the demandOn the flip side if there are more sellers than buyers the fund will become smaller. All unit trust funds performance. Unit Trust Must be registered under CAMA Owns and manages a diversified portfolio and issues units are held under irrevocable trusts and the main objects of which are the provision of non-assignable and non-commutable retirement pensions or annuities for an individual or his dependants. Individual Retirement Unit Account Universal Retirement Fund Pension Plus.

Its a unit trust-linked retirement annuity that offers you investment choice and flexibility. Even with the massive growth in property values the last couple of years. It doesnt cost an arm and a leg. Retirement Options available to retiring professionalsLinksOrganic Growth Premium Investment Club httporganicgrowthcozaclub Books.

I have an existing living annuity.

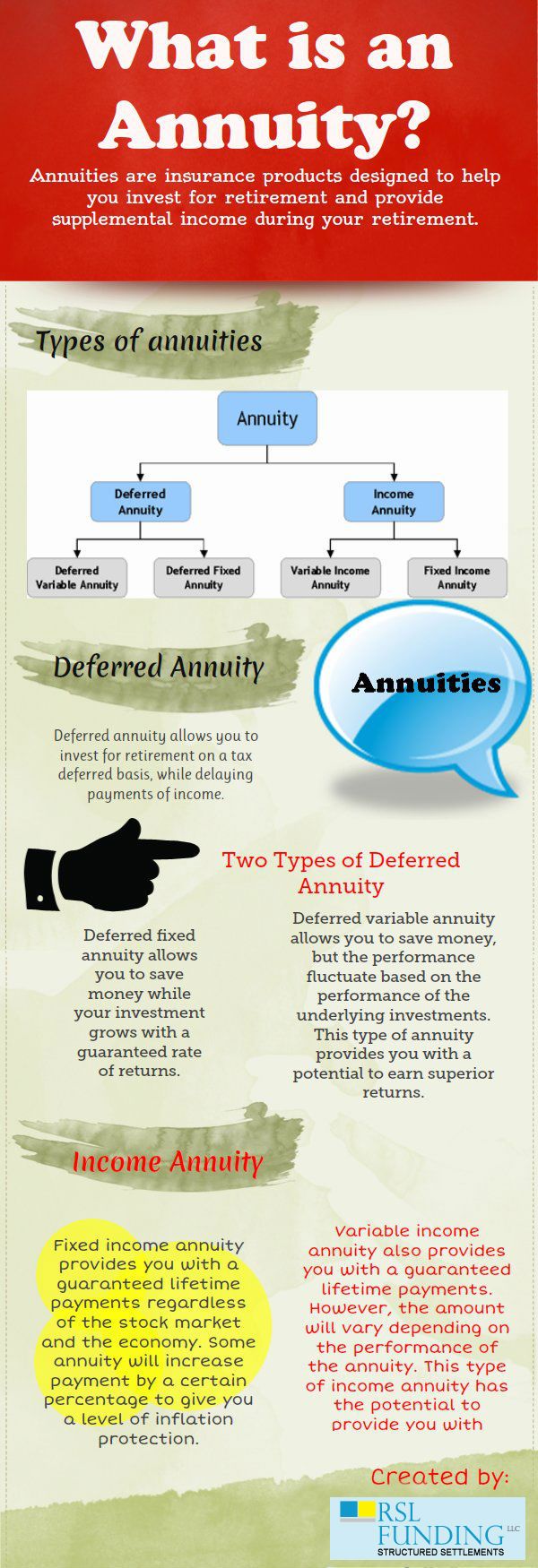

What Is An Annuity Investing For Retirement Annuity Investing

Tax Free Savings Investments Unit Trusts Sharetrading Offshore Investments Sanlam In 2021 Tax Free Savings Investing Tax Free Investments

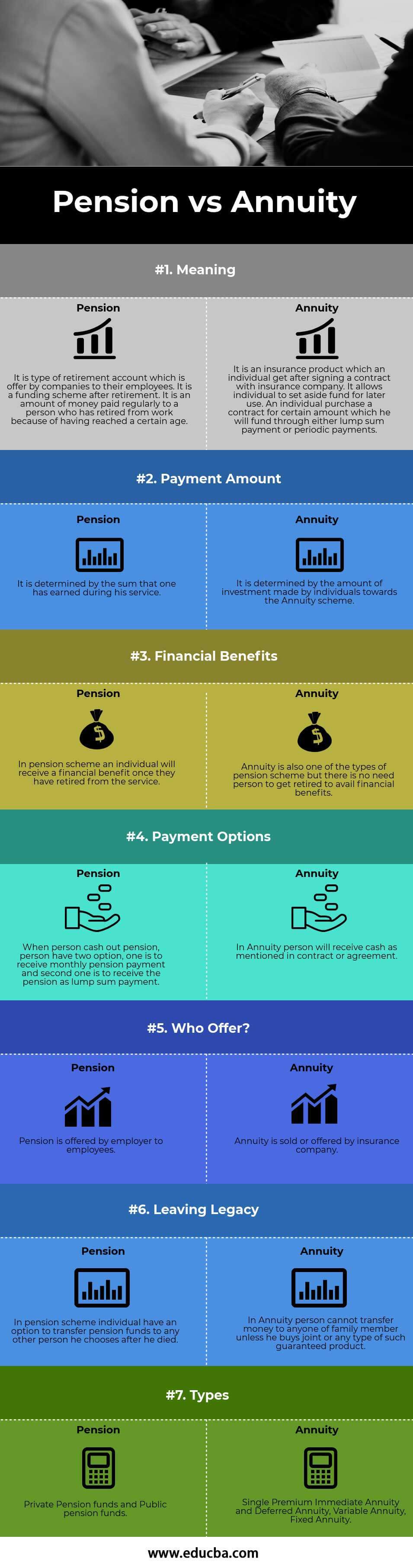

Pension Vs Annuity Top 7 Differences You Should Know

Old Mutual Unit Trusts Retirement Annuity Fund Application Form

Find Your Policy Type What Type Do I Have Phoenix Life

Pension Vs Annuity Top 7 Differences You Should Know

Can I Withdraw My Old Mutual Retirement Annuity What Are The Rules Annuity Retirement Annuity Pension Fund

Post a Comment for "Unit Trust Vs Retirement Annuity"